UPDATE: On April 19, the Treasury department added the Volkswagen ID.4 to the list of vehicles qualifying for the full $7,500 tax credit.

On April 18, 2023, the number of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) eligible for an Internal Revenue Code (IRC) Section 30D tax credit shrank considerably. According to the Internal Revenue Service, 22 EVs now qualify for IRC Section 30D tax credits, down from 41. Of these, 14 qualify for the full $7,500 credit and 8 for $3,750.

Qualifying for the full $7,500 credit:

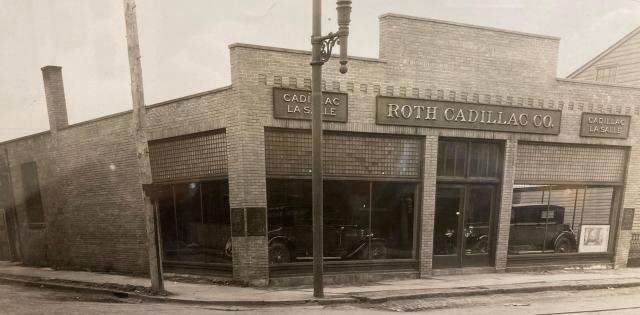

- Cadillac Lyriq EV (2023-2024)

- Chevrolet Blazer EV (2024)

- Chevrolet Bolt EUV (2022-2023)

- Chevrolet Bolt EV (2022-2023)

- Chevrolet Equinox EV (2024)

- Chevrolet Silverado EV (2024)

- Ford F-150 Lightning, standard range (2022-2023)

- Ford F-150 Lightning, extended range (2022-2023)

- Tesla Model 3, performance (2022-2023)

- Tesla Model Y, all-wheel drive (2022-2023)

- Tesla Model Y, long range (2022-2023)

- Tesla Model Y, performance (2022-2023)

- Chrysler Pacifica PHEV (2022-2023)

- Lincoln Aviator Grand Touring PHEV (2022-2023)

Qualifying for $3,750 credit:

- Ford E-Transit (2022-2023)

- Ford Mustang Mach-E, standard range (2022-2023)

- Ford Mustang Mach-E, extended range (2022-2023)

- Tesla Model 3, standard range rear-wheel drive (2022-2023)

- Ford Escape PHEV (2022-2023)

- Jeep Grand Cherokee PHEV 4xe (2022-2023)

- Jeep Wrangler PHEV 4xe (2022-2023)

- Lincoln Corsair Grand Touring PHEV (2022-2023)

The Department of Energy has a tool on fueleconomy.gov that provides a table of all Section 30D qualifying make/models/variants. There are two search categories or, as the site refers to them, “Purchase Scenarios”: One for vehicles placed in service between Dec. 31, 2022, and April 17, 2023; and one for vehicles placed in service on or after April 18, 2023.

Consumers and dealers don’t need to know the specifics regarding battery and mineral content. In this context, the only relevant information for a consumer considering purchasing an EV is whether that vehicle qualifies for a tax credit.

Importantly, most EV make/models potentially qualify for an IRC Section 45W tax credit (the credit for vehicles used for business purposes) if sold to commercial customer-taxpayers. This includes leasing companies intending to lease the vehicle to commercial or noncommercial customers.

Please note, it is always important to check the Section 30D qualifying list and with your vehicle manufacturers as EV make/models may be added to or fall off the list as circumstances change.

For more information on the Section 30D tax credits, on the Section 45W tax credits or on other EV incentives, please see www.nada.org/ev-incentives.