The article below is sourced from Bloomberg Wire Service. The views and opinions expressed in this story are those of the Bloomberg Wire Service and do not necessarily reflect the official policy or position of NADA.

Ford Motor Co. will invest $3 billion to build its highly profitable Super Duty F-Series pickup truck at a plant in Ontario, Canada, shifting focus at the site after previously delaying plans for electric sport utility vehicle.

The automaker will open the plant in 2026, employing 1,800 workers making the large work trucks, according to a statement Thursday. The move will add 100,000 units worth of Super Duty production. Ford is on pace to make about 400,000 of the trucks a year.

The move underscores changes in the market, after slowing growth in EV demand led Ford to put off a three-row plug-in model until 2027. Meanwhile, buyers want more of its large trucks and the automaker needed to change course to meet demand.

“Super Duty is a vital tool for businesses and people around the world and, even with our Kentucky Truck Plant and Ohio Assembly Plant running flat out, we can’t meet the demand,” Chief Executive Officer Jim Farley said in the statement.

Ford said there will be electrified versions of the Super Duty in the future, but didn’t specify whether they would be hybrid-electric vehicles or fully electric. A hybrid using both an electric motor and fossil fuels is better for towing.

Ford shares were little changed in premarket trading in New York.

When Ford announced the delay of production for the big electric SUV in April, the company said the move was being made to “allow for the consumer market for three-row EVs to further develop.”

Electric vehicle sales are still growing — including an 11% rise in the US last quarter to a record 330,000, according to a report from Cox Automotive. But the pace has slowed as middle-income Americans have balked at higher prices and a dearth of charging. That has pushed automakers to delay investment and production plans while Tesla Inc., America’s EV leader, has slashed prices and battled sales weakness.

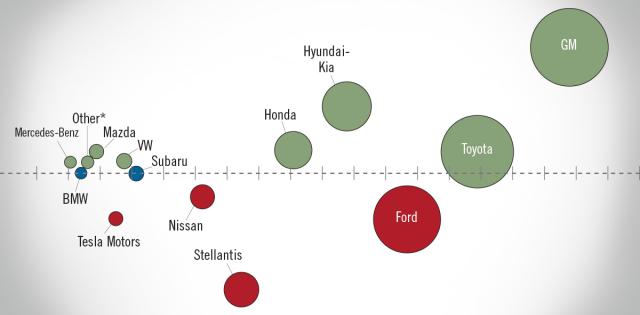

Ford isn’t the only manufacturing rethinking its EV plans. Rival General Motors Co. delayed the opening of a plant in suburban Detroit that is slated to build electric pickup trucks and CEO Mary Barra backed off the company’s goal of installing enough production for 1 million EVs at the end of next year.

Despite continued EV growth, inventory is sitting on lots longer than conventional models. In the past 30 days, dealerships in the US sold 24% of their EV inventory while moving 38% of other models, according to Cloud Theory, which tracks inventory movement.

For more stories like this, bookmark www.NADAheadlines.org as a favorite in the browser of your choice and subscribe to our newsletter here: