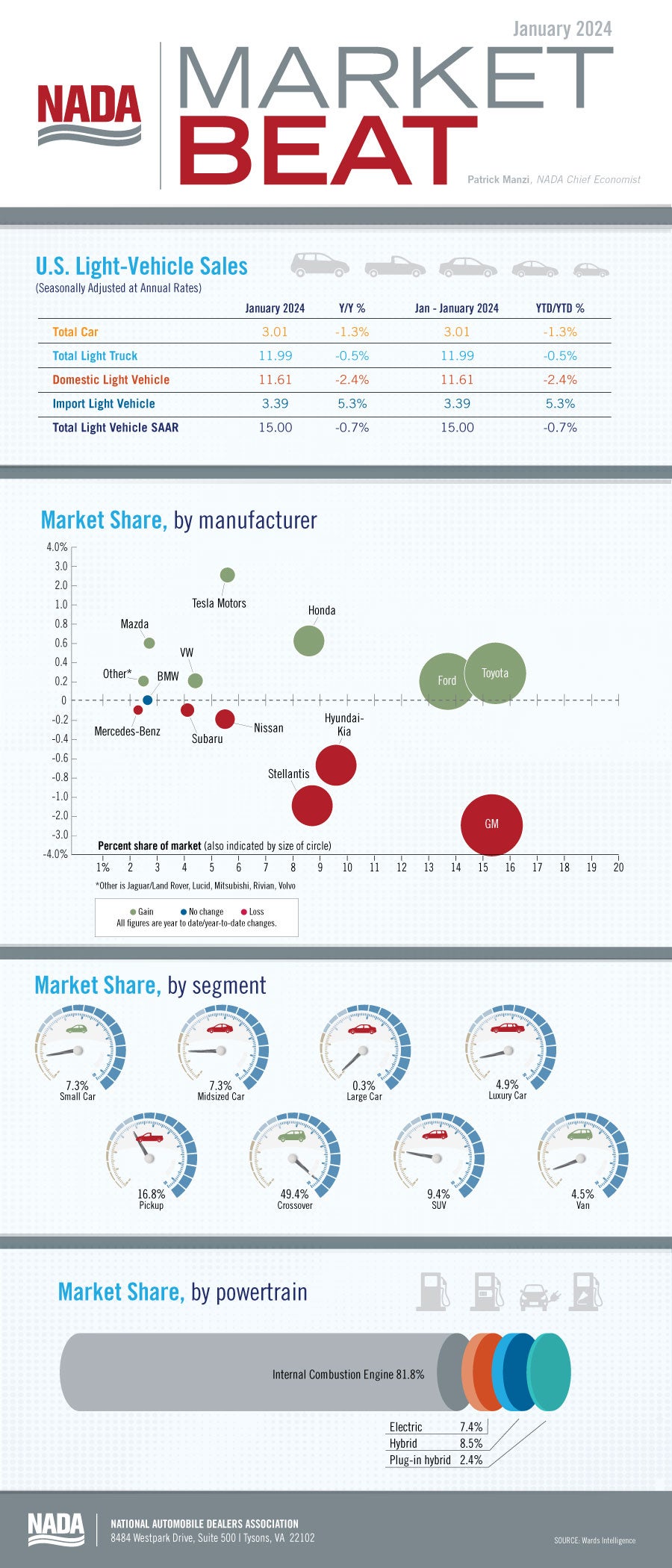

New light-vehicle sales cooled at the start of 2024. The January 2024 SAAR of 15.0 million units represents a decline of 5.6% compared with December 2023 and 0.7% compared with January 2023. It is likely that some of January’s sales volume was pulled into December 2023, given the increase in OEM incentive spending seen at the end of 2023. According to J.D. Power, average incentive spending per unit likely totaled $2,346, down $287 compared with December 2023.

In January, sales of alternative fuel vehicles continued to chip away at the market share held by internal combustion engines (ICE). Sales of alternative fuel vehicles represented 18.2% of all new vehicles sold in January 2024. Battery electric vehicles (BEVs) represented 7.4% of all new vehicles sold and BEV sales increased by 9% year-over-year.

New light-vehicle inventory increased at the end of January 2024 to 2.40 million units, an increase of 40.4% compared with January 2023 and 4% compared with December 2023. The inventory mix in January 2024 was somewhat skewed toward more expensive models. But given the affordability constraints of consumers in the current high interest rate environment, we foresee the OEMs increasing builds of more affordable trims and models in 2024.

Looking ahead to the rest of 2024, we expect new light-vehicle production to increase in 2024. And new light-vehicle inventory will rise slowly throughout the year as higher production is somewhat offset by higher demand. Our forecast for new light-vehicle sales for all of 2024 is 15.9 million units.

NADA Market Beat: 2024 Starts with 15 Million Unit SAAR

Published

Author

Image

Image