The article below is sourced from Reuters Wire Service. The views and opinions expressed in this story are those of the Reuters Wire Service and do not necessarily reflect the official policy or position of NADA.

The U.S. House of Representatives narrowly voted on Thursday to approve legislation to tighten rules limiting Chinese content in vehicles qualifying for U.S. electric vehicle tax credits.

The House voted 217 to 192 to approve the bill, which has not been taken up by the Senate, to tighten the definition of Chinese components that make vehicles ineligible for U.S. EV tax credits.

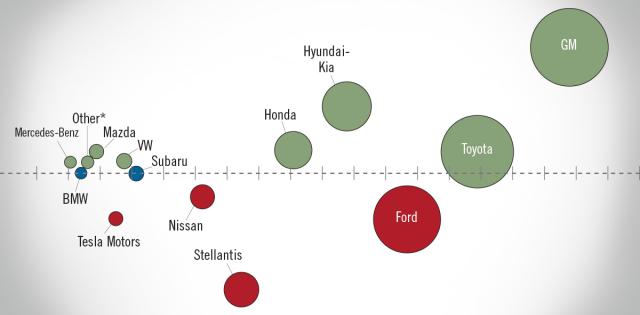

The Alliance for Automotive Innovation, which represents General Motors, Toyota Motor, Volkswagen, Hyundai and other car companies, said the bill would result in fewer vehicles qualifying and would mean aggressive rules on vehicle emissions and EV targets would need to be rolled back.

The automaker group CEO, John Bozzella, said those standards were based in part on the availability of EV tax credits and if the incentives are eliminated "the automotive industrial base faces a serious economic and national security risk from China, the U.S. becomes less competitive, and the rug is pulled out from consumers."

The bill, sponsored by Representative Carol Miller, would tighten the definition of a so-called "Foreign Entity of Concern" that applies to China and other countries. She said it would "ensure that Chinese companies can no longer benefit from electric vehicles tax credits meant for U.S. manufacturers."

The rules required under an August 2022 law are designed to wean the U.S. electric vehicle battery supply chain away from China.

The U.S. Treasury and Chinese Embassy in Washington did not immediately comment.

Currently, 22 of the 113 EV or plug-in hybrid models for sale in the United States are eligible for the EV tax credit - and just 13 get the full $7,500 credit, Bozzella said.

In May, the U.S. Treasury gave automakers additional flexibility on battery mineral requirements for electric vehicle tax credits on some crucial trace minerals from China, such as graphite.

The department said it would give automakers until 2027 to remove some hard-to-trace minerals like graphite contained in anode materials and critical minerals contained in electrolyte salts, binders, and additives.

For more stories like this, bookmark www.NADAheadlines.org as a favorite in the browser of your choice and subscribe to our newsletter here: