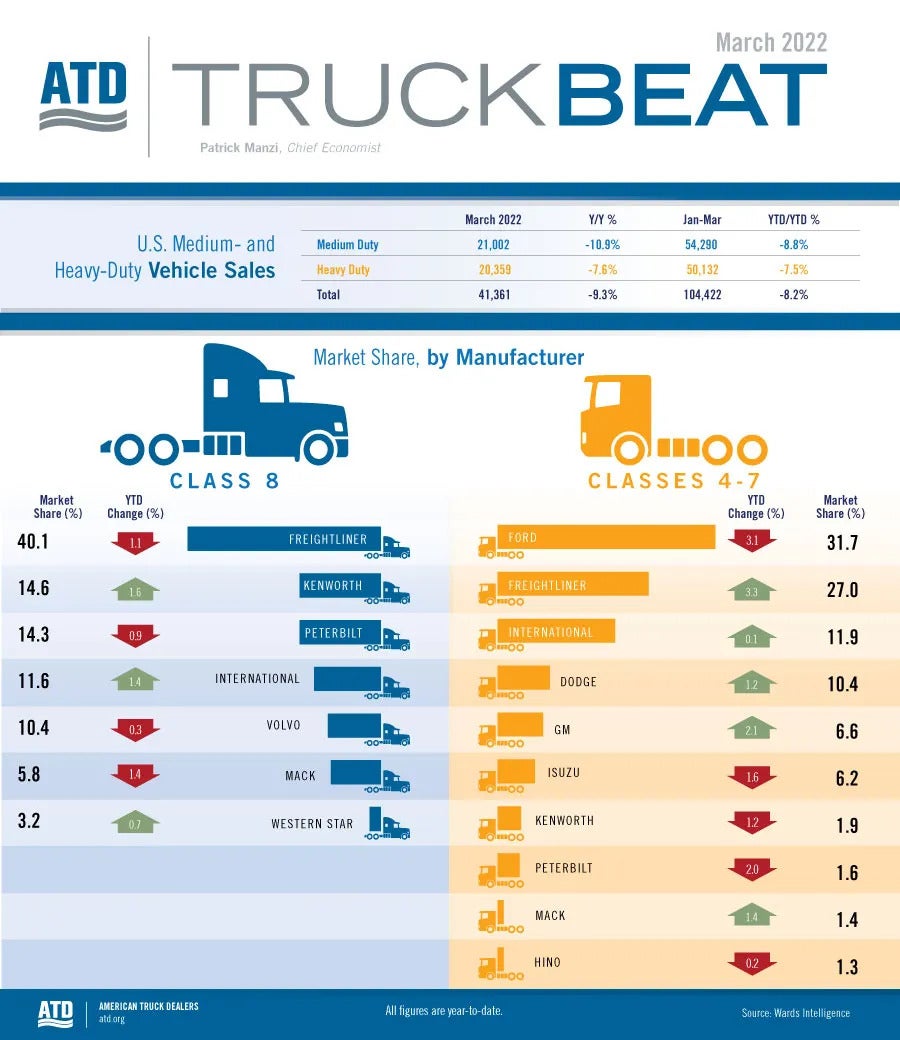

In March 2022, commercial truck sales hit their highest levels so far this year, but at the end of first quarter 2022 remain down compared with the end of Q1 2021. In March, medium-duty truck sales were down by 10.9% and heavy-duty truck sales were down by 7.6% from March 2021. For the whole quarter commercial truck sales were off by 8.2% compared with the end of first quarter 2021.

The commercial truck industry continues to deal with tight supplies of semiconductor microchips and other production inputs, which have limited the number of new trucks OEMs can build. Similar to the light-duty market, most OEMs expect that microchip availability and new-truck production will improve throughout the year. Commercial truck order backlogs have limited the number of new orders OEMs are taking, even though demand for new trucks continues to be strong. Orders for Class 8 trucks in March 2022 topped 21,000 units according to ACT Research and FTR. Orders in March were up by 3% month over month, but down by 47% from March 2021.

Tight supplies of new trucks continue to push prices higher for used trucks in March. According to ACT Research, average prices for Class 8 trucks hit an all-time record, topping $94,000 and beating the previous high, set in January. And February 2022’s record price marked an increase of 83.1% compared with the previous February.

Despite the challenges the commercial truck industry will face throughout the rest of the year, we expect that total sales of commercial trucks in 2022 will increase over 2021’s. Our forecast for 2022 sales remains at 240,000 medium-duty trucks and 250,000 heavy-duty trucks.